-

The Future

-

AX(AI Transformation)

AX(AI Transformation)While many technological innovations have transformed enterprise work environments, none have brought change as profound as artificial intelligence (AI). In today’s business landscape, AI is no longer just another technology, it has become a driving force behind fundamental business transformation. In a future shaped by agentic AI and AX, only companies that work with partners offering visionary leadership and innovative technologies will secure lasting competitiveness.

-

AX(AI Transformation)

-

Services

-

IT Infrastructure on Cloud

IT Infrastructure on CloudIT Infrastructure on Cloud strategy! Build a better business by leveraging all of these technologies.Cloud

- # Cloud Migration Roadmap

- # Multi-Cloud Enablement

- # Cloud-Native Adoption

- # AI Strategy on Cloud

- # Cloud Cost Optimization

Infrastructure- # Hybrid Cloud

- # Multi-Infrastructure Ops

- # AI Infrastructure Setup

- # Industry-Specific 5G

- # Flexible Infra Design

Data Center- # Data Center

- # DC Consulting Services

- # DC Deployment Considerations

- # DC Build & Operations

- # DC Total Lifecycle

Security- # Cybersecurity Consulting

- # Integrated Security Services

- # Custom Security Solutions

- # OT Security Implementation

- # Security Threat Management

-

AI

AIDiscover the most important driver of corporate innovation and the AI offering best suited to your business.Agentic AI

- # AgenticWorks

- # AI Orchestration

- # AI Partnership

- # AI Management

- # Integrated AI Services

AX Platform- # AX Platform Architecture

- # DAP GenAI Knowledge Lake

- # DAP GenAI Image/Text

- # DAP MLDL

- # DAP Vision

AX Consulting- # AI Strategy Consulting

- # Tailored AI

- # AI-Driven Process Innovation

- # AI Implementation Metrics

- # AI Governance

AICC- # AI Consultation Bot

- # Gen AI Consultation Service

- # Journey-Based Engagement

- # Cloud Contact Center

- # Contact Center Cost Saving

Virtual Factory- # Manufacturing Trends

- # Digital Twin Solutions

- # Digital Transformation

- # EPC Digital Transformation

- # CPM Deployment

-

Biz Data

Biz DataDeal with the fast-changing environment effectively with new business insights and a Gen AI Ready platform.

-

Biz Process Intelligence

Biz Process IntelligenceStart leading change by innovating how you work with more efficient and sustainable operations.Digital AX

- # Reinvent work with a:xink

- # Future of Work

- # AI-Driven Workplace Platform

- # Digital EX with AX

- # NEXT ITSM Solution

Sales & Customer Service Management- # AI Device Platform

- # AI Contact Center

- # Subscription Management

- # Converged MVNO Services

- # AI Product Management

Business Management- # AI Business Management

- # Business Mgmt Readiness

- # Equipment Efficiency

- # SPACE-N Solution

- # Business Support System

SCM- # SCM Strategy Planning

- # SCM Diagnosis Consulting

- # Demand-Driven Production

- # Supply Chain Planning

- # Vendor Management System

ESG- # Custom ESG Consulting

- # ESG Disclosure & Ratings

- # ESG Management Platform

- # Digital Safety System

- # Risk Monitoring Platform

-

Enterprise Solution

Enterprise SolutionTry out tech-focused business solutions that can improve every part of your work.ERP

- # Cloud ERP Migration

- # AI-Driven ERP PI

- # Next-Gen ERP

- # ERP Architecture

- # SAP ERP Operations

SINGLEX- # Global SCM Risk Control

- # HR Management Solution

- # AI for Manufacturing

- # AI Quality Management

- # AI-Driven CRM

Enteprise SW- # PerfecTwin Test Automation Solution

- # Web3 Adoption Strategy

- # Data-Driven Ad Operation

- # LENA Cloud Middleware Optimization

-

Customer Experience

Customer ExperienceProviding consistent and empathetic experiences throughout the customer journey with AI and data-driven personalized services.

-

Smart Factory

Smart FactoryExperience sustainable growth by applying AX to all manufacturing processes, including product development, process management, and production logistics.Manufacturing Execution Management

- # MES Data Integration

- # MMD Efficiency Enhancement

- # Expected MES Outcomes

- # Real-Time Process Monitoring

- # WMS Optimization Strategy

Process Management- # Recipe Management System

- # Productivity & Quality Boost

- # Quality Issue Management

- # Process Anomaly Detection

- # Real-Time Anomaly Alert

Production Logistics Management- # Smart Factory Logistics

- # Real-Time Dispatcher

- # Process Computerization

- # DAQ System

- # Digital Twin for Facilities

Product Development Management- # PLM Platform Adoption

- # Collaborative Dev Environment

- # Digital Design Platform

- # Optimized R&D Environment

- # Software-Defined Vehicle

-

Smart Logistics

Smart LogisticsDiscover smart logistics that evolve on their own through total solutions that cover the entire process from design to operation.

-

Smart City & Space

Smart City & SpaceExplore a new paradigm for future spaces that offer a better life, focusing on mobility and data.

-

Consulting

ConsultingConsulting services that drive customer innovation and growth, delivering tangible value.

-

Industry-Specific Services

Industry-Specific ServicesFinance

- # Card All-in-One Solution

- # Digital Banking

- # Custom Insurance Service

- # Advanced Insurance System

- # Tokenized Securities Platform

Education- # AI Language Education

- # AI Tutor Solution

- # EdTech Service Deployment

- # AI Digital Textbook

- # Personalized Learning Content

Public Services- # Mobile ID Service

- # Decentralized ID Use Case

- # E-Wallet Service

- # ID Verification Service

- # Mobile ID Fraud Prevention

Oil&Gas and Petrochemical- # AX Strategy

- # Digitalizing Manufacturing

- # Factory Operations Optimization

- # Industry-Specific AI Service

- # ESG Management

Pharmaceutical and Biotech- # Pharma/Bio AX Strategy

- # R&D Innovation

- # Digitalized Manufacturing

- # Smart Logistics Automation

- # AI Safety & Compliance

-

IT Infrastructure on Cloud

- The Future

-

Services

IT Infrastructure on CloudBiz DataBiz Process IntelligenceEnterprise SolutionCustomer ExperienceSmart FactorySmart LogisticsSmart City & SpaceConsultingIndustry-Specific Services

No search results found.

Industry-Specific Services

FinanceRecent trends in the financial industry include the expansion of digital banking, the growth of fintech, increasing ESG investments, the adoption of AI and machine learning, and the rising importance of private financial services. Digital banking, driven by advances in internet and mobile technologies, enables clients to handle most financial transactions without visiting a branch. Meanwhile, fintech companies are delivering innovative services across payments, loans, investments, and insurance, intensifying competition with traditional financial institutions.

Investments that prioritize Environmental, Social, and Governance (ESG) factors are also on the rise, with investors focusing more on companies practicing sustainable management. AI and machine learning technologies are enhancing efficiency and enabling personalized financial services. By leveraging big data analytics, financial institutions can predict client behavior and deliver customized products and services.

LG CNS is a leading innovator in the financial industry and remains committed to continuously developing diverse and advanced financial services aligned with technological progress.

No.1 Financial IT Partner for Business Success

Recent trends in the card business are rapidly evolving alongside digital transformation. Mobile payment services are growing fast, driven by the increasing use of non-face-to-face payment methods, with fintech companies playing a key role. Consumers now enjoy a convenient payment environment through smartphones, supported by QR code payments, Near Field Communication (NFC), and other methods.

Card companies actively analyze client consumption patterns using big data and AI to deliver customized benefits and services, enhancing client satisfaction. Blockchain technology is also gaining attention for its role in strengthening security and trust. Additionally, card companies are expanding partnerships to offer more client benefits—a trend expected to continue.

LG CNS is responding to market changes by adopting strategies such as accelerating digital transformation, leveraging big data and AI, strengthening security, supporting ESG management, enhancing client experience, and expanding partnerships.

We support various payment methods including mobile, QR code, and NFC payments, while utilizing big data and AI technologies to analyze consumption patterns and offer customized services. Furthermore, we are advancing flexible IT systems that can maximize client benefits through partnerships with various partners.

These strategies enable LG CNS to effectively navigate the rapidly changing card business environment.

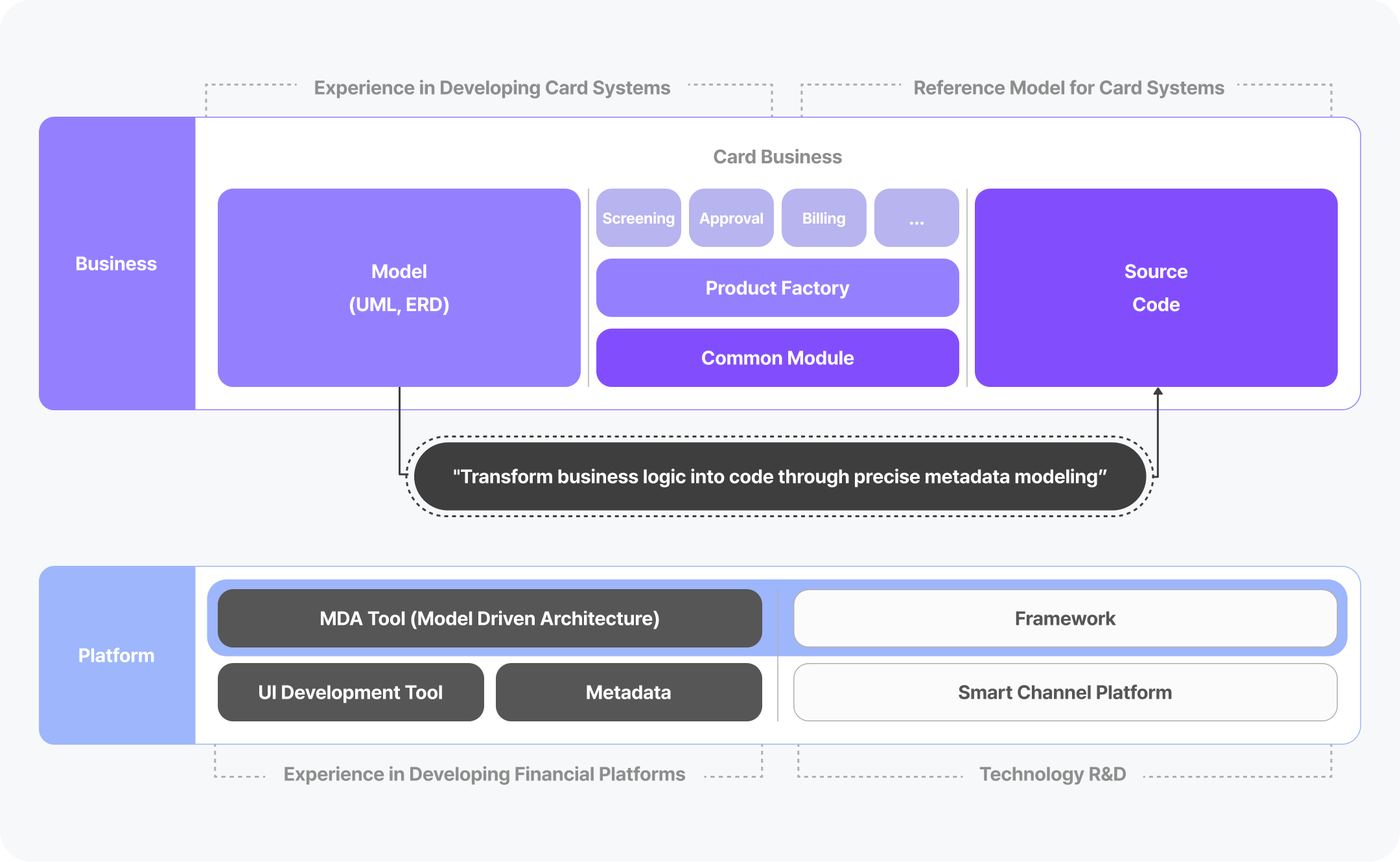

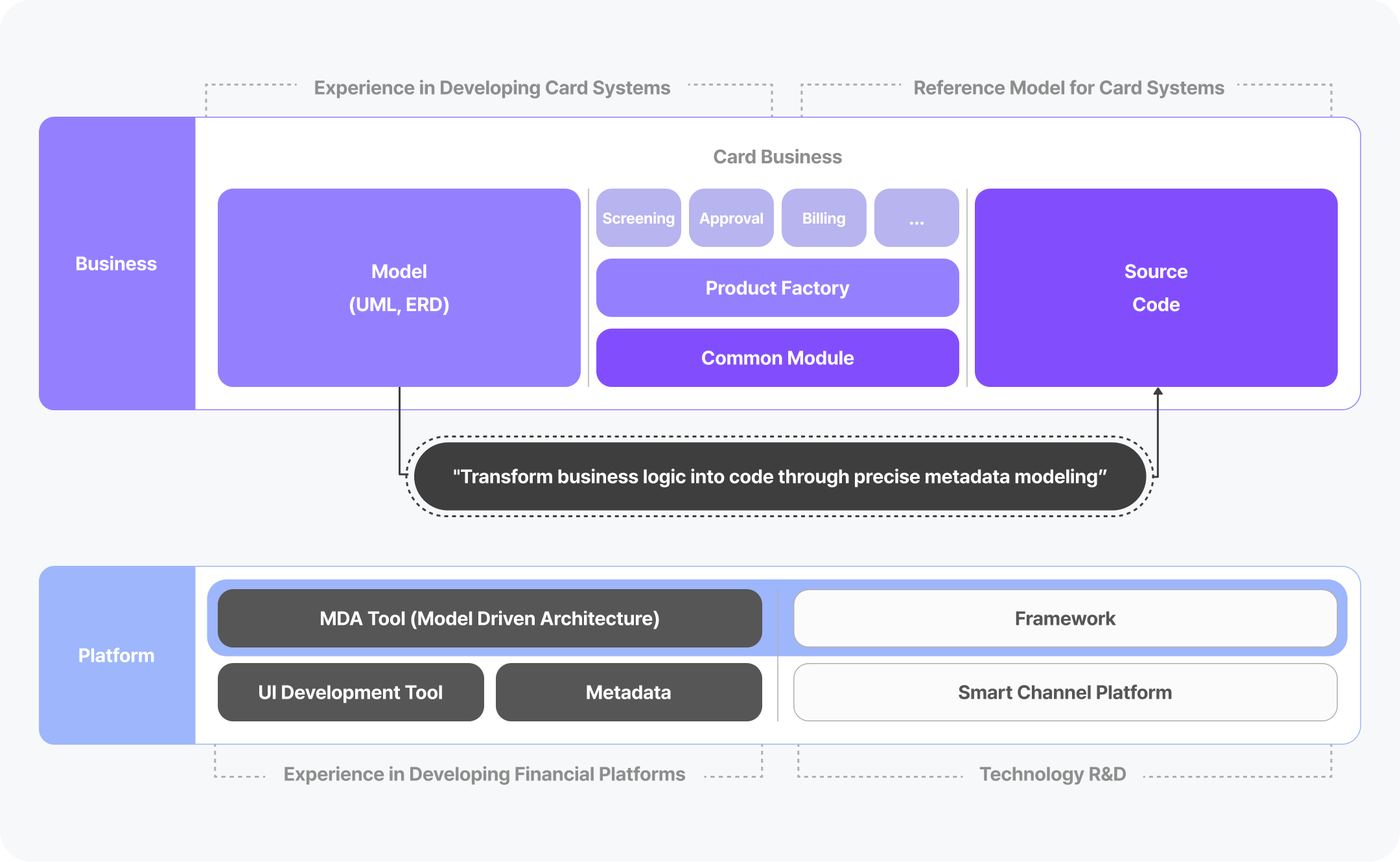

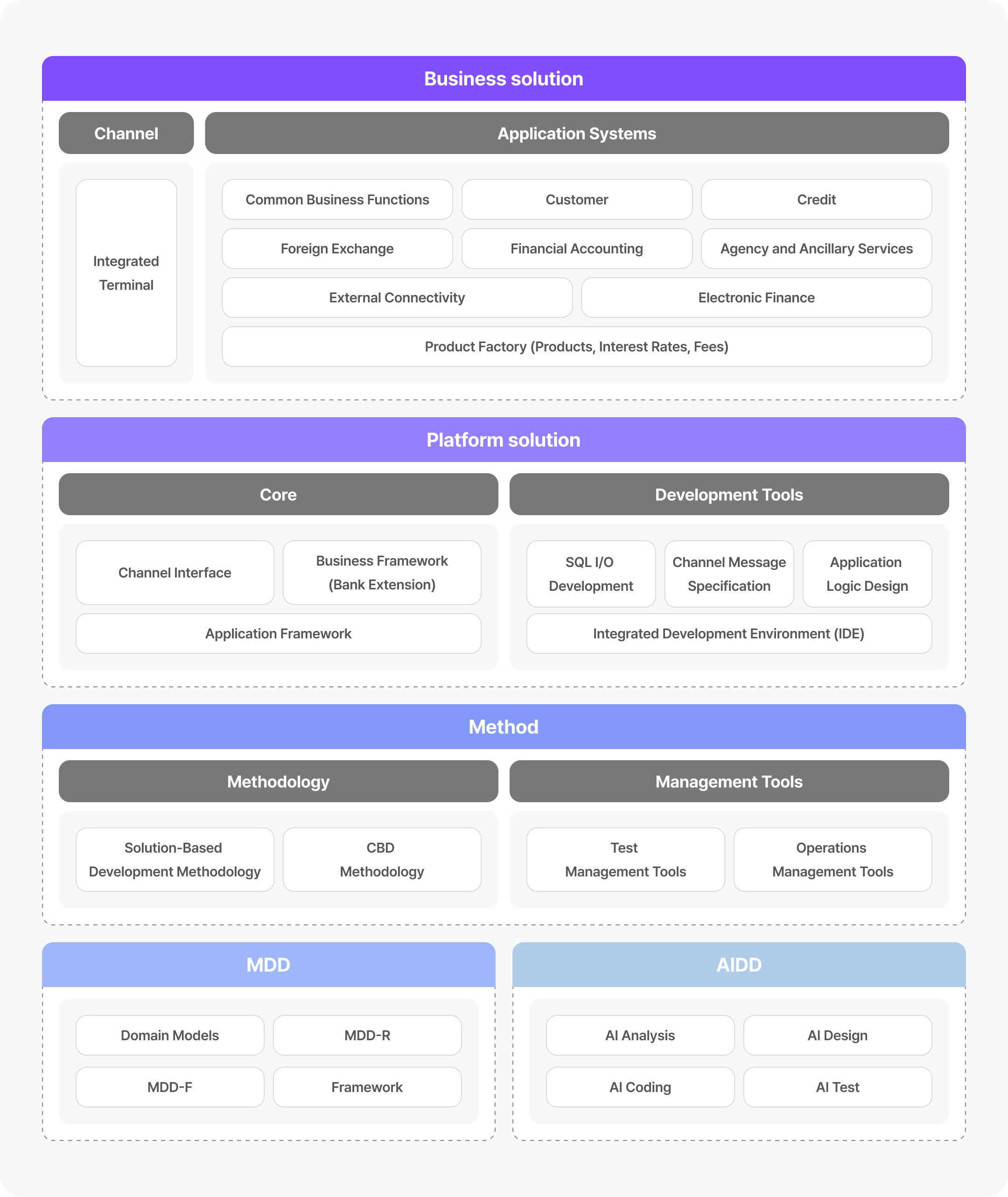

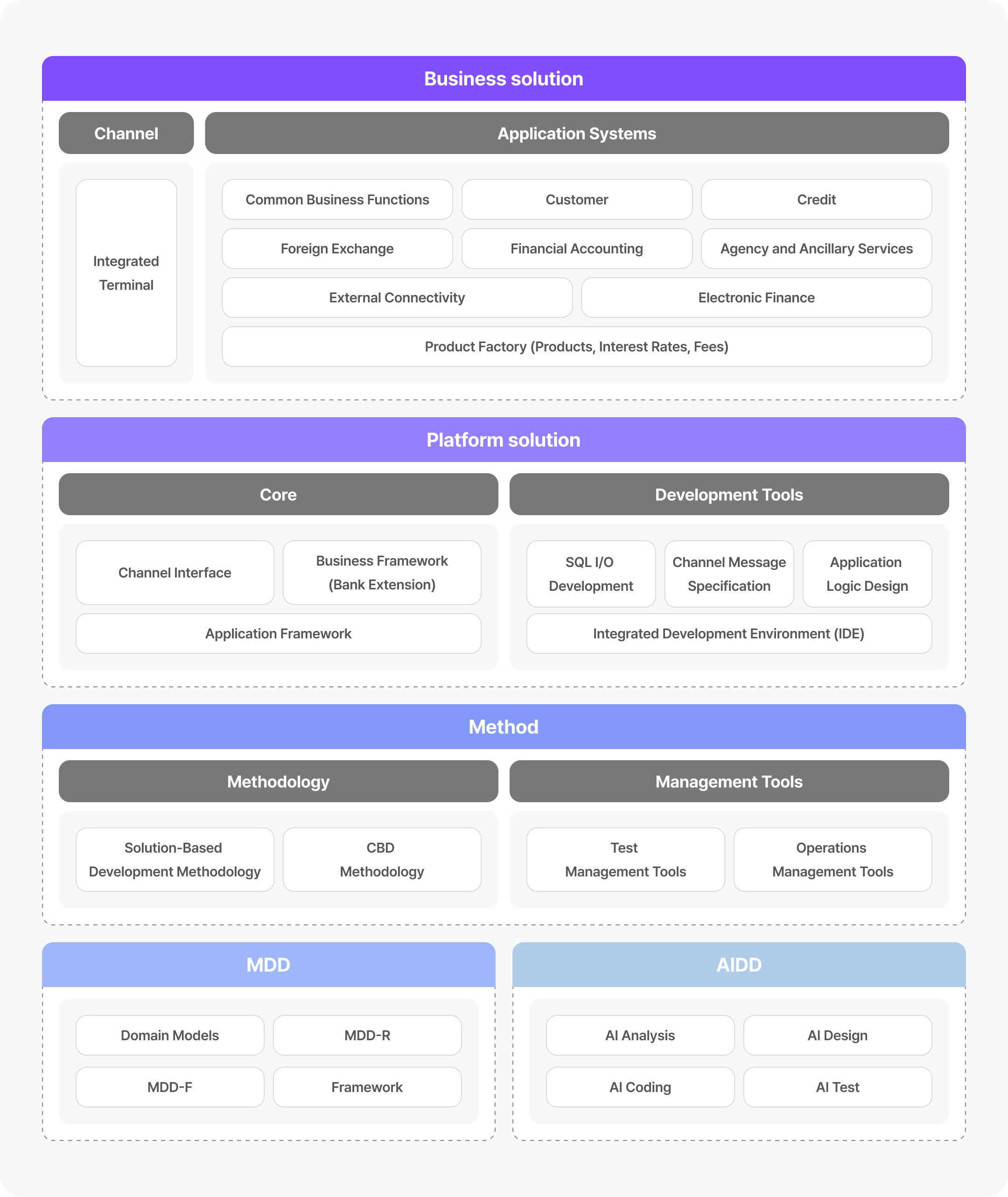

LG CNS CardPerfect is a business development platform built on best practices, integrating business solutions, frameworks, and development tools into an all-in-one solution.

It supports the entire credit card business process and is designed as a model-based solution with scalable architecture and excellent development efficiency. The system is also integrated with finance-specialized UI solutions and FEP solutions tailored for card business operations.

No.1 Financial IT Partner for Business Success

IT has become a key driver for banks to maintain competitiveness and improve client experience. Banking operations are evolving rapidly through digital transformation, enhanced cybersecurity, open banking, cloud utilization, and data analytics. Mobile banking and AI-based personalized services are expanding, making it essential for banks to provide better client experiences as a core competitive advantage.

Korean banks are expanding their global operations, entering Southeast Asia—including Vietnam and Indonesia—as well as Japan, the United States, India, and Eastern Europe. This creates a growing demand for banking systems tailored to local markets, global payment systems, and customized IT services. By quickly establishing robust IT systems and ensuring stable operation and continuous improvement, banks strengthen their global competitiveness and create new opportunities.

Customized IT Technologies for Banks

LG CNS swiftly delivers the latest technologies to banking clients. Our services include next-generation systems using AI coding, AI-based financial product recommendations, AI chatbots for bank customer consultation using LLMs, mobile banking, and My Data platform construction. By working with LG CNS, banks can improve their business processes, adapt to technological advancements, and launch new services leveraging emerging technologies.

Global System Development Capabilities

As a global business partner, LG CNS supports Korean banks in building IT systems for overseas branches. We developed the global next-generation system for Hana Bank and the IT systems for KB Kookmin Bank’s Southeast Asia subsidiaries. We also provided IT systems for banks in Singapore, proving our capabilities in global banking system development. LG CNS continues to expand with banking clients into larger markets.

LG CNS banking solutions have been verified through projects with major domestic clients such as Kakao Bank and Toss Bank, as well as overseas clients like PCC Bank. Leveraging accumulated know-how, we minimize risk and maximize productivity and output quality in every project.

No.1 Financial IT Partner for Business Success

The insurance industry is evolving rapidly with digital transformation. Many insurance companies are enhancing customer-centric services and improving operational efficiency using digital technologies. Insurance products are now sold through online platforms and mobile apps, while services such as customer support and claims processing are being automated. Big data and AI are actively used to analyze customer needs and expectations. Insurers are offering customized products and services, applying advanced analysis for fraud detection and risk assessment to increase customer satisfaction.

LG CNS is responding to market changes by accelerating digital transformation, strengthening client-centric strategies, utilizing big data and AI, collaborating with InsurTech, supporting ESG management, enhancing risk management and product innovation, and addressing regulatory changes.

We build systems that support AI-based underwriting, fraud detection, and smart housing subscriptions. By analyzing diverse client data, we deliver customized services using big data and AX technologies. These strategies enable LG CNS to respond effectively to the rapidly changing insurance business environment.

InsuTower is a comprehensive solution that supports the entire insurance service process, from enrollment and maintenance to payout and accounting linkage. It is designed with a model-based architecture that offers scalability and development efficiency. InsuTower supports core insurance operations such as new contracts, contract changes, claims and payments, sales management, and integrated client information management. Through customized configurations, InsuTower allows flexible and agile responses to changing business needs.

No.1 Financial IT Partner for Business Success

Since the early 2000s, the securities industry has advanced from Home Trading Systems (HTS) to Mobile Trading Systems (MTS) with the spread of the Internet. During the pandemic, non-face-to-face transactions surged, while individual investors expanded into overseas markets and diverse products such as stocks and bonds. As a result, many securities firms are seeking the optimal infrastructure environment and focusing on building hybrid IT systems.

Security Token Offering (STO) Issuance and Distribution Platform

LG CNS provides a platform that meets the growing demand for security token issuance and distribution. Our platform implements a technical architecture that fully integrates the entire process of security token issuance and distribution with blockchain smart contracts. This ensures data consistency between distributed ledgers and legacy systems while providing a scalable environment that supports various blockchain networks.

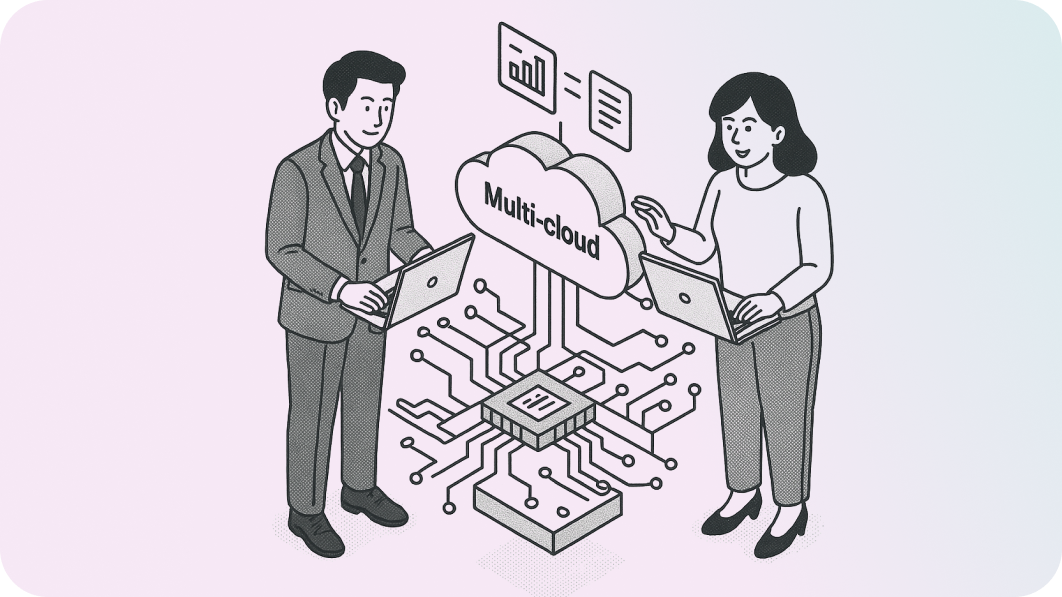

No.1 Integrated Managed Service Provider (MSP) with Proven Multi-Cloud Capabilities

Leveraging unique expertise and top-tier partnerships with Google, AWS, and Microsoft, LG CNS delivers optimal cloud solutions for the increasing cloud migration and deployment needs of securities clients. We provide landing zone design and construction strategies, securities-specialized cloud services, and continuous modernization and optimization through CloudXper ProOps. Our services also cover application management, DevOps operations, and integrated security management and operation solutions.

Top System Integration Partner with Proven Quality and Resources

With years of experience and skilled professionals, LG CNS ensures successful system implementation through a robust quality assurance process. We are adopting the latest technological trends to propose a flexible architecture and transfer technical know-how to clients. Our services support not only securities firms such as Mirae Asset, KB Securities, and Shinhan Securities but also institutions like the Korea Exchange and the Korea Securities Depository.

LG Science Park, E13/E14, 71 Magokjungang 8-ro, Gangseo-gu, Seoul, Republic of Korea

©LG CNS. All rights reserved.

LG CNS Cookies

We use cookies to provide you with a convenient web browsing

experience and to continuously improve functionality through traffic

analysis.

By clicking

‘Accept all cookies’,

you agree to our use of cookies. Click

‘Reject all cookies’

to decline all non-essential cookies. See

Privacy Policy

for details.